Life Insurance – Lead Generation Campaign

📌 Goal: Generate High-Quality Life Insurance Leads

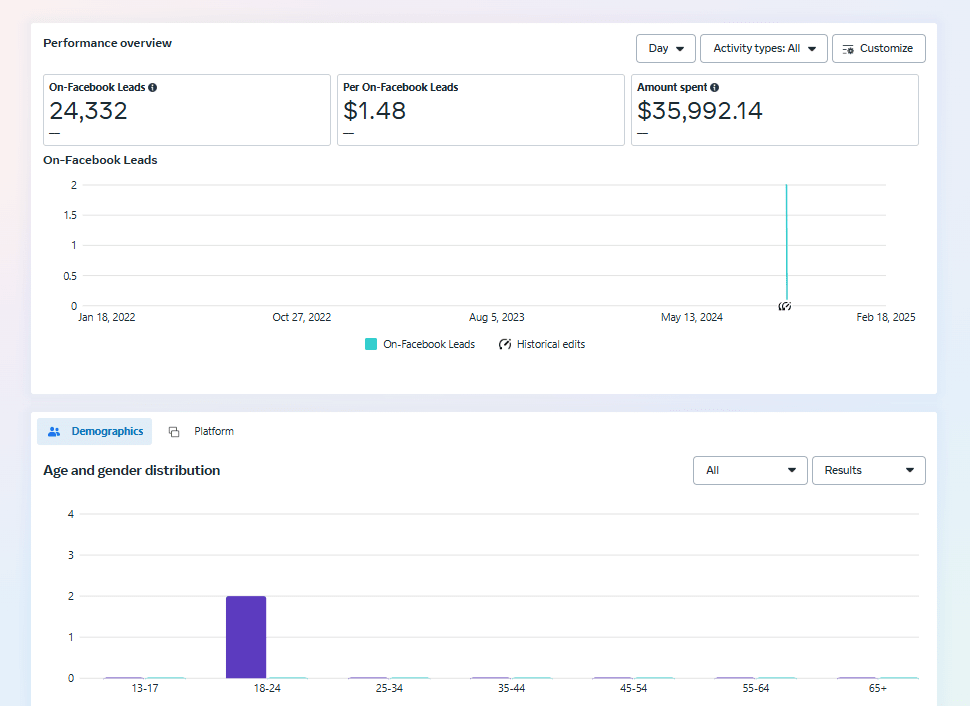

💰 Total Ad Spend: $35,000

👥 Leads Generated: 24,000

💲 Cost Per Lead (CPL): $1.48

1️⃣ Strategy & Planning Phase

For life insurance, the primary goal is to build trust while educating potential clients. Here’s the approach:

- Target Market Analysis: Focused on families, young professionals, homeowners, and retirees

- Lead Qualification: Emphasized pre-screened leads with questions about age, coverage type, and budget

- Education-Based Funnel: Provided valuable information and reassurance regarding coverage options and pricing

- Funnel Goal: To create leads that are ready for consultation or quoting with clear intent

2️⃣ Audience Targeting Strategy

Optimizing for high-intent buyers:

- Demographics: Age 25-55, homeowners, married with children, recent life changes (e.g., marriage, new children, new home)

- Interests: Life insurance, financial planning, term life, whole life, final expense

- Behaviors: Recently searched for insurance quotes, comparison shoppers, or engaged with insurance-related content

- Custom Audiences: Previous visitors to the website, people who downloaded insurance guides, prior consultation leads

- Lookalike Audiences: Built from high-converting leads and CRM data of existing clients

- Exclusions: Excluded low-intent or irrelevant segments based on past interactions

3️⃣ Funnel Structure

A high-conversion funnel designed for life insurance prospects:

- Top of Funnel (TOF): General awareness with educational content: “Why Life Insurance is Important” & “How to Choose the Right Coverage”

- Middle of Funnel (MOF): Free quotes, comparison tools, and detailed benefit lists (e.g., term vs. whole life insurance)

- Bottom of Funnel (BOF): Retargeted leads who viewed specific policy pages or began filling out forms but didn’t submit—offered urgency with time-sensitive quotes or discounts

- Lead Forms: Quick forms with qualifying questions like “Do you have dependents?” and “What coverage amount are you interested in?”

4️⃣ Creatives & Messaging Strategy

Ads were created to speak directly to pain points and life goals:

- Ad Types: Video explainer ads, carousel ads with different policy benefits, image ads with personal success stories

- Key Messaging:

- “Protect your family’s future today.”

- “Find the best life insurance rates for you.”

- “Secure your loved ones with affordable life insurance.”

- “Protect your family’s future today.”

- Trust Signals: Testimonials, expert endorsements, and clear calls to action

- CTAs: “Get Your Free Quote,” “Learn More,” “Find the Right Plan for You”

5️⃣ Optimization & Lead Quality Control

Maintaining a low CPL while ensuring high-quality leads:

- Pixel & Conversions API Integration: Full tracking across devices to monitor lead behavior and conversion rates

- Lead Routing: Integrated leads with the CRM to ensure timely follow-up and lead qualification

- A/B Testing: Headline variations, ad copy, form fields, and creative types (static images vs. videos)

- Follow-Up Automation: Automated email and SMS follow-ups within seconds of lead submission to improve response rates

- Lead Segmentation: Based on coverage needs, budget, and urgency to ensure leads are assigned to the correct sales team

✅ Results & Outcomes

- Total Spend: $35,000

- Leads Generated: 24,000

- Cost Per Lead (CPL): $1.48

- Lead-to-Quote Conversion Rate: ~22% (tracked via CRM and consultation appointments)

🏆 Result: Efficient lead generation with cost-effective CPL and a steady flow of high-quality life insurance leads, ready for consultation or direct follow-up.